The digitalisation process of tax certifications, which started in January with the introduction of the electronic invoice, continues: a process that represents one of the main levers for disseminating digital culture within the world of business, improving administrative processes and reducing management costs, with a positive impact on fiscal compliance.

From the 1st of July the obligation to issue an electronic receipt comes into force for subjects conducting retail trade and similar activities and that, currently, are not obliged to issue an invoice to customers, unless the document is requested by the customer: the obligation immediately comes into force for about 260,000 retailers with a turnover exceeding 400,000 euros, for all others starting from the 1st of January 2020. The Payment Lottery, in which consumers who purchase goods or services from operators who transmit payments digitally can take part, will begin from the same date.

The introduction of the electronic receipt, which will gradually phase out paper receipts, will not entail substantial changes for customers who will receive a document (paper or digital) to be used as a guarantee of purchases and for related deductions.

HOW IT WORKS

With the introduction of the electronic receipt, operators will now have quick and easy access to data on their sales, which will be transmitted directly to the Italian Revenue Agency, with the possibility of more timely checks and quicker analysis of possible risks of tax evasion.

To issue the electronic receipt it is necessary to use digital cash registers that communicate constantly with the Revenue Agency. For this purpose it will be necessary for the operator to buy a new digital cash register, obtaining a tax credit of 50% of the value up to a maximum amount of 250 Euro, or adjust their current cash register, receiving a tax credit of up to 50 euros. The new terminals will also allow small businesses to further digitise their activities and simplify data storage, accounting and calculations for tax obligations.

As an alternative to the use of digital cash registers, it is possible to store and send data on daily payments to the Revenue Agency through its new web service, available in the reserved area of the Invoices and Payments portal. Through the web procedure - which can be used on tablets and smartphones, as well as from a PC - interested parties can prepare a commercial document online and store and send data on the payments of every single transaction made to the Revenue Agency at the same time. To access the system you can use your credentials for SPID (Public digital identity system), Entratel and Fisconline digital services or the National Services Card (CNS).

As for electronic invoicing, the digital transmission of data on daily payments must be carried out within 12 days, to be calculated in relation to the date of the transactions, also to promote compliance by operators that operate in areas with poor Internet coverage.

TRANSITION PERIOD

To allow gradual compliance with the obligation to electronically store and digitally transmit payments, operators who don’t yet have a digital cash register available can fulfil the obligation to transmit data on daily payments by the end of the month following the month of the transaction, without incurring penalties, without prejudice to the terms for the liquidation of value added tax. This provision only applies for the first six months of the entry into force of the obligation to electronically store and digitally transmit payments, commencing on 1st July 2019 for companies with a turnover exceeding 400,000 Euro and from 1st January 2020 for other companies. The procedure for only transmission of daily payments will be defined in an upcoming measure of the Director of the Revenue Agency.

EXEMPTED PARTIES

All subjects that, under current legislation, fall outside the perimeter for certification of payments, are exempt from the obligation to issue an electronic receipt, thereby confirming the exemptions from tax certification that currently exist. These include tobacconists, newsagents, sellers of agricultural products and those who provides services for telecommunications, broadcasting and public transportation of passengers and vehicles (if the travel ticket coincides with the receipt). Furthermore, until 31st December 2019, the exemption is extended to companies who make marginal transactions, i.e. those which do not exceed 1% of the total turnover in 2018, and sales and services performed on means of transport in international travel (e.g. cruise ships); these subjects will continue to certify these marginal transactions on paper.

THE INTERNATIONAL CONTEXT

Italy is at the forefront among countries that have embarked on the process of digitalisation of tax certifications.

As is clear from the OECD report "Implementing Online Cash Registers", there are still a few examples in this direction in other countries: Portugal has adopted a system that uses the data from invoices to identify discrepancies and fraud between VAT paid and invoices sent by taxpayers to the administration. In Sweden sales must be recorded on a cash register terminal connected to a fiscal control unit, certified by the Swedish Tax Administration. In the Netherlands a certification mark, which can be adopted on a voluntary basis, has been developed to indicate that a cash register meets the requirements for reliably storing and managing data, making possible irregularities in the transaction visible. At the beginning of 2017 Russia started to move toward the obligation of online cash registers, which instantaneously load data on purchases in the database of the Tax Administration.

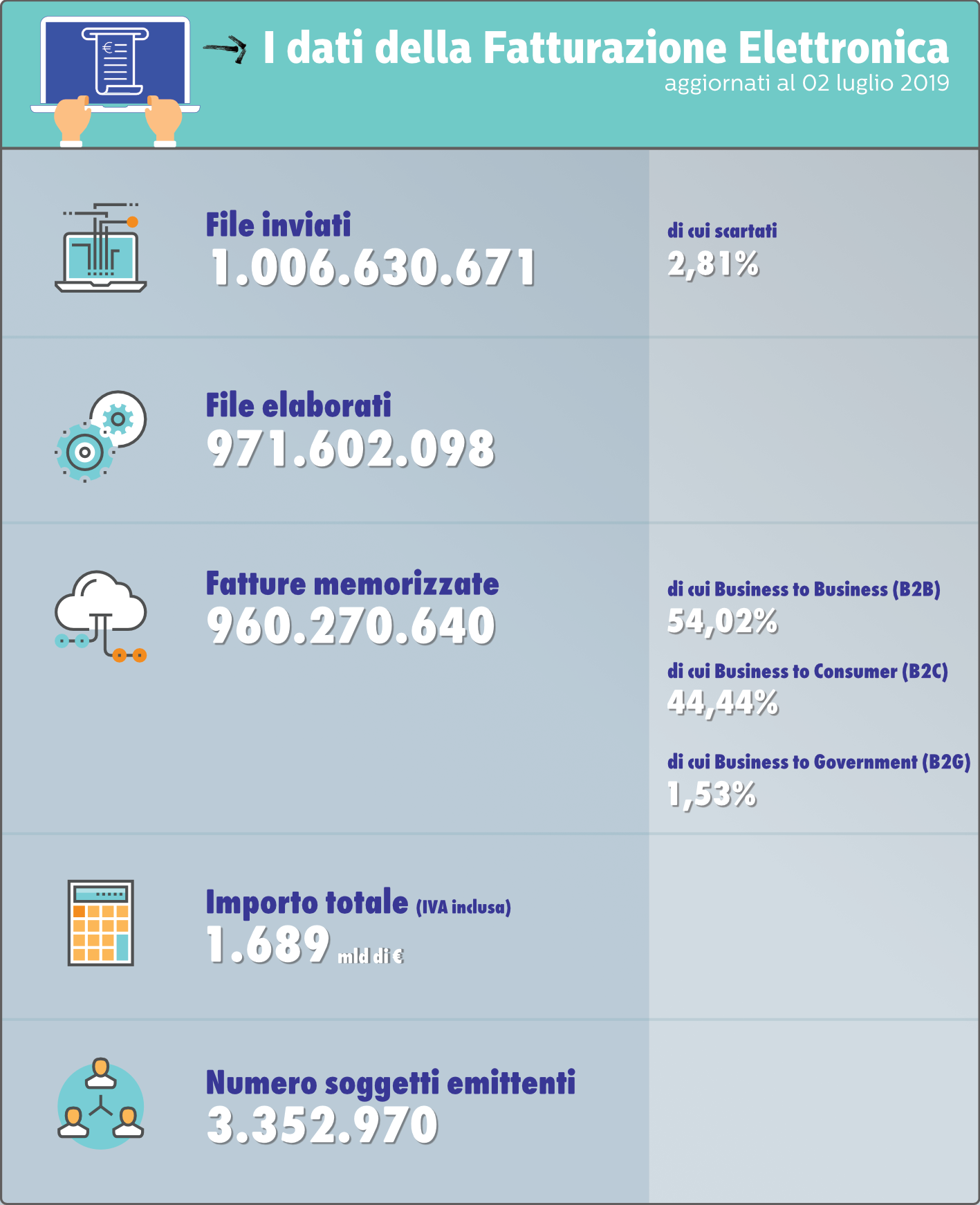

Infographic showing data on electronic invoicing to 02 July, which show a growing trend with respect to the May data.